The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit). The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. The most important thing to note by comparing the stockholders’ equity section in both balance sheets is that the total is $3 million In both cases. The only difference is the total of the various accounts within stockholders’ equity.

The Nature and Purposes of Dividends

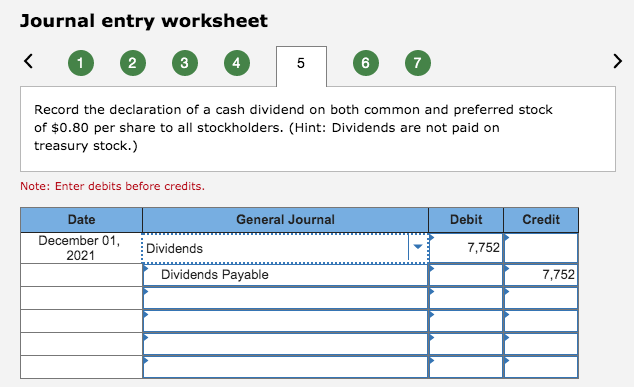

The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit). The board of directors of a corporation possesses sole power to declare dividends. The legality of a dividend generally depends on the amount of retained earnings available for dividends—not on the net income of any one period. Firms can pay dividends in periods in which they incurred losses, provided retained earnings and the cash position justify the dividend. And in some states, companies can declare dividends from current earnings despite an accumulated deficit.

Dividend Accounting

Assuming there is no preferred stock issued, a business does not have to pay dividends, there is no liability until there are dividends declared. As soon as the dividend has been declared, the liability needs to be recorded in the books of account as dividends payable. Since the cash dividends were distributed, the corporation must debit the dividends payable account by $50,000, with the corresponding entry consisting of the $50,000 credit to the cash account.

What are Dividends Payable?

There is no change in total assets, total liabilities, or total stockholders’ equity when a small stock dividend, a large stock dividend, or a stock split occurs. A stock split causes no change in any of the accounts within stockholders’ equity. The impact on the financial statement usually does not drive the decision to choose between one of the stock dividend types or a stock split. Large stock dividends and stock splits are done in an attempt to lower the market price of the stock so that it is more affordable to potential investors.

- And in some states, companies can declare dividends from current earnings despite an accumulated deficit.

- Most of the time, businesses and business owners aren’t required to issue dividends.

- Whether you issue dividends monthly or choose to only issue dividends following a strong fiscal period, you’ll need to record the transaction.

- Large stock dividends do not result in any credit to additional paid-up capital.

Comparing Small Stock Dividends, Large Stock Dividends, and Stock Splits

When a cash dividend is declared by the board of directors, debit the retained earnings account and credit the dividends payable account, thereby reducing equity and increasing liabilities. Thus, there is an immediate decline in the equity section of the balance sheet as soon as the board of directors declares a dividend, even though no cash has yet been paid out. Sometimes companies choose to pay dividends in the form of additional common stock to investors. This helps them when they need to conserve cash, and these stock dividends have no effect on the company’s assets or liabilities. The common stock dividend simply makes an entry to move the firm’s equity from its retained earnings to paid-in capital.

Some companies issue shares of stock as a dividend rather than cash or property. This often occurs when the company has insufficient cash but wants to keep its investors happy. When a company issues a stock dividend, it distributes additional shares of stock to existing shareholders. These shareholders do not have to pay income taxes on stock dividends when they receive them; instead, they are taxed when the investor sells them in the future. Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits.

They are ‘dividends’ in the sense that they represent distribution to shareholders. Companies issue stock dividends when they want to bring down the market price of their common stock. A stock dividend is a type of dividend distribution in which additional shares are distributed to shareholders, usually at no cost. These new shares are then traded on the same exchange at current market prices. If the company prepares a balance sheet prior to distributing the stock dividend, the Common Stock Dividend Distributable account is reported in the equity section of the balance sheet beneath the Common Stock account.

When investors receive a stock dividend, the cost per share of their original shares is reduced accordingly. It is a temporary account that will be closed to the retained earnings at the end of the year. The final entry required to record issuing a cash dividend is to document the entry on the date the company pays out the cash dividend. The first step in recording the issuance of your dividends is dependent on the date of declaration, i.e., when your company’s Board of Directors officially authorizes the payment of the dividends. To illustrate, assume that Ironside Corporation declared a property dividend on 1 December to be distributed on 4 January.

This records the reduction of the dividends payable account, and the matching reduction in the cash account. When a dividend is later paid to shareholders, debit the Dividends Payable account and credit the Cash account, thereby reducing both cash and the offsetting liability. On the initial date when a dividend to shareholders what is the available balance in your bank account is formally declared, the company’s retained earnings account is debited for the dividend amount while the dividends payable account is credited by the same amount. On the payment date of dividends, the company needs to make the journal entry by debiting dividends payable account and crediting cash account.