Rahat oyun site simülatörler oyun hizmeti yasal platform başarı bet

Oyun projesi sağlar yeni ve düzenli ziyaretçiler çeşitli ayar slotlar ve masa oyunları son derece ünlü tematik satıcılar.site ziyaretçiler sağlanır son derece rahat koşullar oyun süreci öğeleri müşteriler oyun kitaplığı slot makineleri 24 saat erişime alın ve sonuç olarak bir profili onaylama – turnuvalar ve promosyonlar , bonus programı.

Oyun çevrimiçi hizmet kumarhane başarı bet< /h2>

İsteğe bağlı olanı inceleyin ziyaretçiler fırsata sahip olacak lisanslı çevrimiçi hizmet basaribet casino giriş kumarhane. Menü site maksimum basitleştirilmiş ve erişilebilir yeni başlayanlar için bile.Kullanıcı web projesi için gerekli tüm araçlara sahiptir tek tıklamayla git gerekli alt bölüm.

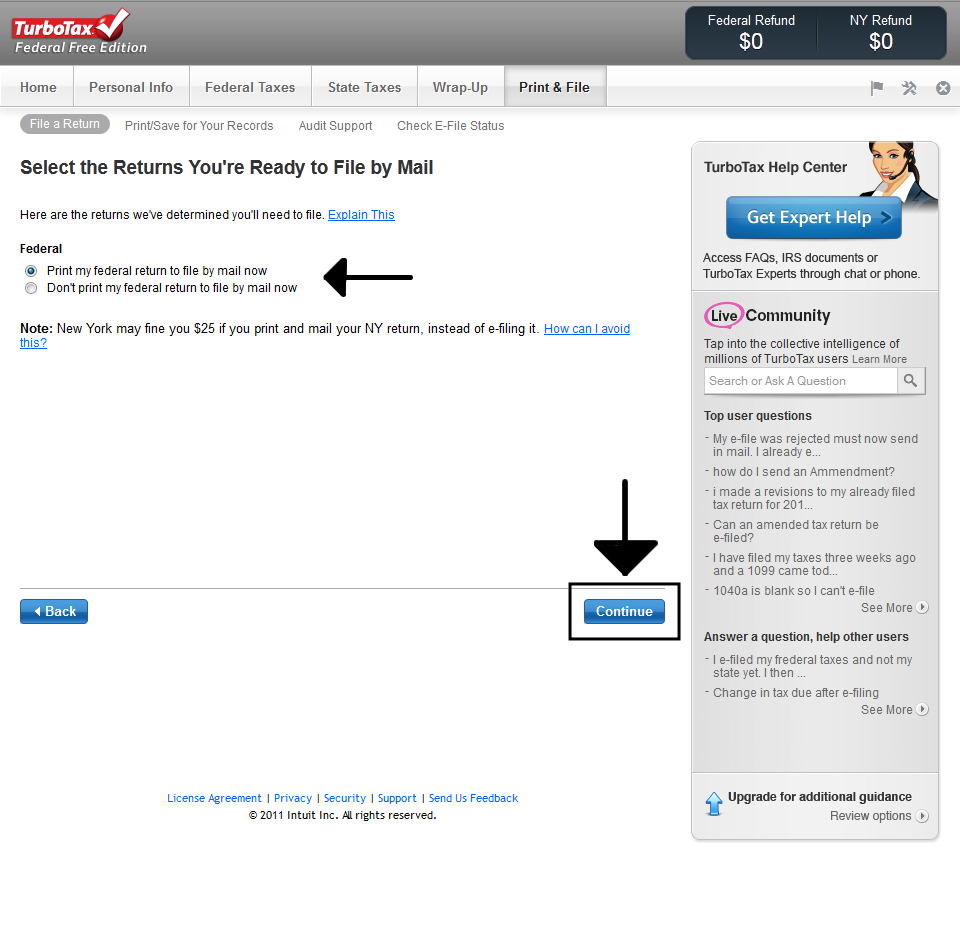

Kime kullanmak tüm isteğe bağlı özellikler kumar platformu basaribet, öncelikle gerekli bir hesap etkinleştirin. Bu görevi uygulamak tavsiye edilen: tıklayın sekme üst panelde; select yöntem profil etkinleştirme (e-posta veya telefon numarasıyla); kayıt formundaki alanlara gerekli verileri girin; onayla kişisel bilgiler e-posta veya SMS yoluyla.

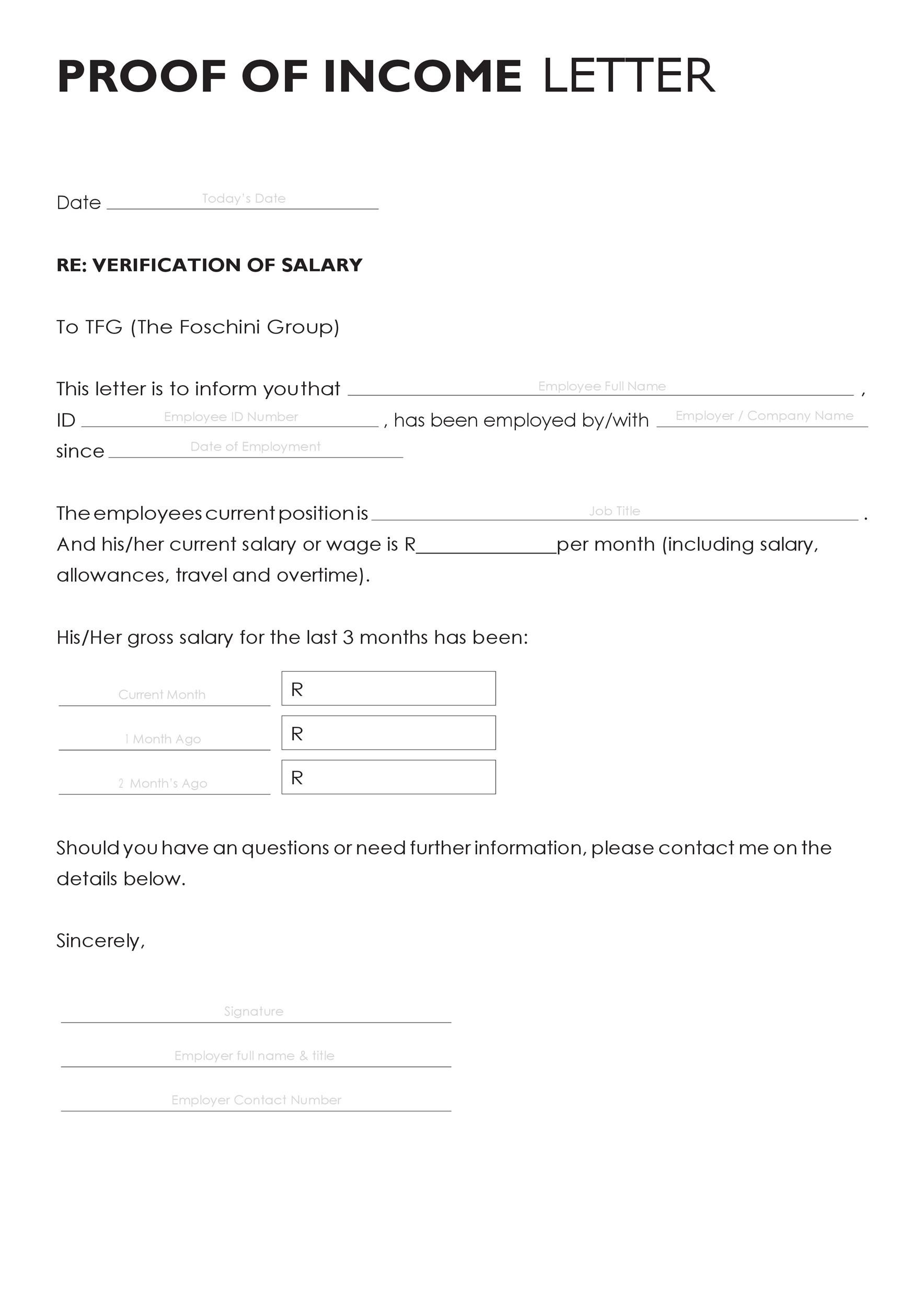

Özel veriler, ne kullanıcı girer kayıt pencerelerinde, girdi için tasarlanmıştır hesap içinde yetkilendirme için İçin para için oynamak ve kaydet kazino bonuslar başarıbet, kullanıcı gerekli para yatırın.Bunun için sanal web platformu mevcut çeşitli işlem hizmetleri – banka kartları, mobil operatörlerin hizmetleri aracılığıyla para yatırma, İnternet bankacılığı, kripto para cüzdanları, vb. Ne zaman kullanıcı seçer ödeme hizmeti, ayrıntılarını girmesi gerekir seçilen sistem hatasız .Ödeme yaparken değiştir onların yasak – sonuçta aynı ayrıntılar gerçekleştirilecek sonraki tüm ödemeler çevrimiçi kulüp.

Slot makineleri nasıl oynanır alternatif kumarhane bağlantıları aracılığıyla başarıbet

Ayrıca zamanla test edilmiş çevrimiçi hizmet, tüm işlevler İnternet kulüp etkinleştir zaten mevcut tanımlayıcılar. alternatif platformlar oyuncu ilgili bakiyedeki para, bonus fonlar ve veriler profil. Ne zaman istemci henüz zamanı olmadı kaydol, yapabilir kişisel bir hesap açabilir herhangi bir klonlama İnternet platformları.

:brightness(10):contrast(5):no_upscale()/student-loan-application-185305410-5ad405d143a10300373e7e0d.jpg)