- FHA finance are guaranteed by the Federal Construction Management to make homebuying inexpensive, particularly for first-day homeowners. FHA funds enjoys lower interest levels and lower credit history and downpayment requirements than conventional finance.

- Va money try guaranteed by Service out-of Veterans Affairs in order to help effective-obligations provider members and you will pros purchase a home. Continue reading Medical professionals usually have large student loan debt and inconsistent money, particularly when these are typically simply getting started

Monthly Archives: October 2024

What is the lowest paycheck required for a mortgage from inside the Southern Africa?

- Are you 18 decades otherwise old?

- Are you experiencing a-south African ID?

- Is your latest income stable?

- Is the credit rating fit?

- Have you searched your value with a no cost thread calculator?

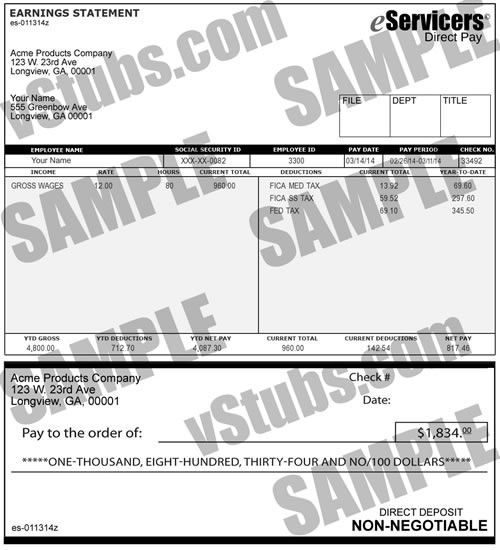

- Whether you are care about-working or an excellent salaried private, maybe you have waiting most of the documentation you’ll need for the borrowed funds software?

- Note: those people who are mind-employed will require additional documents of those who have a manager.

There are certain solutions making being qualified for a mortgage Breckenridge loans from inside the Southern area Africa a real possibility, in place of a distant dream. With this thought, its challenging to incorporate at least paycheck needed for a good home loan within the SA because the creditors are prepared to bring an amount borrowed which is about your earnings. The low your income, the low the loan amount in which you normally meet the requirements. Your credit rating will even play a giant character inside deciding how much a financial are ready to give you. As a general rule, don’t be using more than a 3rd of the net monthly earnings towards your monthly bond costs.

On average, how much should i earn to cover home financing?

Once more, this really is a tricky matter to respond to. However, to offer an incredibly crude suggestion, it could be useful to think about what house prices during the for every single province and you may exactly what income you would need to be eligible for to your home financing of the same worth. Continue reading What is the lowest paycheck required for a mortgage from inside the Southern Africa?

HELOC against House Equity Financing: Whats the difference?

Open the benefits of your house owing to home collateral financing otherwise home equity personal lines of credit (HELOCs). Understand the distinctions as well as your alternatives for credit.

Summary of HELOC and Home Guarantee Money

HELOCs and you can house security finance jobs differently, however, both use the security in your home since the security so you’re able to make it easier to secure money to help with a house restoration, higher education, a crisis expenses, or even consolidate higher-appeal financial obligation.

Equity measures the market industry worth of your house as compared to your own mortgage. Such as, should your house is worth $eight hundred,000 plus mortgage stability was $2 hundred,000, you’ve got $200,000 otherwise 50% security of your property. Collateral usually creates over the years because you pay the home loan or increase the well worth of your home that’s the answer to protecting a HELOC or household guarantee loan.

Both HELOCs and you can house security money is simple borrowing from the bank options for residents as they routinely have better interest rates as compared to unsecured loans, handmade cards, and other personal loans. However, there are dangers that come with HELOCs and you can household collateral financing, making it crucial for residents to learn how for each financing really works.

What exactly is property security mortgage?

Home equity money are usually repaired rates, fixed term cost finance which use your home as the guarantee. You’ll sign up for a specific amount of money that have a lender and you may, if the acknowledged, you’re going to get the fresh lump sum up front. Continue reading HELOC against House Equity Financing: Whats the difference?

Latest house security loan prices and you can fashion

- So it week’s family security mortgage pricing

- Newest home collateral financing cost and trends

- Greatest family guarantee loan prices away from

- Evaluating an informed household collateral loan lenders out of

- Reasons why you should get a house collateral financing

- Benefits and drawbacks off a property guarantee financing

- Household guarantee mortgage compared to. HELOC

- House security funds versus. cash-aside refinances

- Exactly who qualifies having a house collateral mortgage?

A property security loan are a fixed-speed repayment loan protected by your household once the an additional home loan. You will get a lump sum payment initial and then pay back the newest loan when you look at the equivalent monthly installments during a period of date. Because your home is utilized since the a security, the lender normally foreclose in it for individuals who standard on the costs.

The interest rate your secure when you take your loan might possibly be constant for your term, even if business interest rates increase

Very loan providers require you to possess fifteen% to 20% collateral in your home to help you safer a home guarantee financing. To choose how much security you have, deduct their kept mortgage balance in the value of your house. Such as for example, in the event your home is worth $five hundred,000 and you owe $350,000, you’ve got $150,000 in collateral. The next step is to choose the loan-to-worth proportion, otherwise LTV ratio, that’s your the financial harmony divided by the house’s most recent really worth. Therefore in this instance the latest calculation is:

Contained in this analogy, you have got good 70% LTV ratio. Extremely lenders allows you to borrow around 75% to ninety% of house’s value without what you owe on your number one financial. Continue reading Latest house security loan prices and you can fashion

Regardless of the higher interest, the home guarantee mortgage now offers John straight down monthly payments and will not disrupt their old age deals

- Household equity mortgage: 8.5% repaired rate, 15-seasons title, $494 monthly payment

- 401(k) loan: nine.5% fixed rates, 5-12 months title, $1,049 payment

Although not, this new 401(k) mortgage is actually decreased regarding total interest paid off, charging $12,940 when you look at the focus money compared to the $38,920 into home security financing.

Other factors to adopt

- HELOCs and you may family security funds want homeownership and you can enough home security.

- Good credit (constantly 680-700 or higher) is typically expected.

- 401(k) loans will be a last hotel, utilized only if almost every other sensible alternatives aren’t readily available.

- Demand a monetary mentor to check your specific disease and you can mention all of the financing possibilities before deciding.

Sooner, when you find yourself 401(k) money also provide fast access in order to funds, HELOCs and household guarantee loans have a tendency to bring much more positive words and you can never give up your retirement coverage.

not, there clearly was very just one situation where borrowing out of your 401(k) makes sense. And that’s when you yourself have a critical significance of cash and you may simply no other way to access it inexpensively. Perhaps your credit rating is actually reduced or you actually have a lot of established costs to track down a different type of financing. Continue reading Regardless of the higher interest, the home guarantee mortgage now offers John straight down monthly payments and will not disrupt their old age deals

Wells Fargo, Rates, Fairway, Lower make leaders moves

Rates welcomes go back out-of Chris Knapp to joint venture team

launched the newest return out of former manager Chris Knapp once the president out-of its joint venture that have a residential property brokerage Home financing transformation veteran who before spent eleven age towards the Chi town-established national lender, Knapp steps in once the commander off Best Price, responsible for serving subscribers out of ‘ realtors, and tapping into his experience in strategic thought and you will operational administration.

Knapp comes back with the Speed members of the family immediately following has just providing while the government vice president regarding team development from the Draper & Kramer Financial. He along with prior to now kept an option frontrunners role within CrossCountry Mortgage.

recently tapped installment loan companies in Delta OH banking experienced Sandra Ho on the freshly authored status out of head out of conversion process. About character, she’s going to manage new consolidated individual head and marketed sales organizations. Ho relates to Wells Fargo regarding JPMorgan Pursue, in which she offered in many management spots, along with of late given that handling movie director from inside the Chase’s user and small business repayments division. Before in her own financial characteristics field, Ho held ranking within likes away from Innovatus Resource People, McKinsey and you may Co. Continue reading Wells Fargo, Rates, Fairway, Lower make leaders moves

Free Gambling games Gamble Today

Content

If so, you may find the answer you would like regarding the FAQ part lower than. When it comes to online casino games online, 100 percent free enjoy admirers have access to a huge portfolio here for the your website. For many who’re searching for to try out the new game, take a peek less than. Continue reading Free Gambling games Gamble Today

Lowest Deposit Casinos 2024 $1-$10 Limitations to possess Reduced Deposit People

Average casinos also can have the lowest limitations on the deposits, however, such the absolute minimum put will not make athlete eligible to possess a bonus https://vogueplay.com/uk/jurassic-world/ . One-dollar put casino websites, on the contrary, grant incentives on the deposit users, even when the deposit ‘s the smallest you’ll be able to. Continue reading Lowest Deposit Casinos 2024 $1-$10 Limitations to possess Reduced Deposit People

Lucky Larry’s Lobstermania dos Slot Get involved in it free of charge Online

Blogs

Start aboard Happy Larry’s Lobster ship and stay whisked out for the an excellent lobster angling excitement of your Atlantic beaches within the Maine, Australia otherwise Brazil. The game is actually 5-reels and 40-paylines having loads of higher bonus cycles and features. Continue reading Lucky Larry’s Lobstermania dos Slot Get involved in it free of charge Online

Ganzo Knives Repaired Blade Tangerine Free shipping more than $44! CropManage Knowledge Base

To own local casino sites, it’s far better give gamblers the option of trialling an alternative video game free of charge than simply have them never ever try out the fresh gambling establishment games after all. A huge number of casino websites are fighting to suit your some time and interest. Continue reading Ganzo Knives Repaired Blade Tangerine Free shipping more than $44! CropManage Knowledge Base