Melbet Zambia Promo Code & Sign Up Offer 2024

Content

The minimum deposit requirement across most methods is quite low, catering to bettors with different budget ranges. Bingo enthusiasts are also well catered to, with options like live Keno, adding variety to the gaming options available. These games are set up to provide continuous and engaging play, with regular rounds and multiple betting options.

You can also try the application to play games of numerous genres such as slot machines, roulette and various pocket formats or lucky fortune titles from all around the world. The Android version of the MelBet app is designed to be fast, robust and easy to use. Zambian users can download it as an APK file directly from the local version of the sportsbook’s website. To install it, it is key to enable the installation of apps from unknown sources in the device settings. The app provides access to a vast array of betting markets, including popular sports and niche options like eSports. Live betting features add an extra thrill for bettors, especially paired with the free broadcasting feature.

“Meneer Casino’s focus on integrating advanced technologies demonstrates their commitment to providing a top-notch user experience,” said gaming industry analyst, Jane Doe. It is called “Play for free” and can be found on some of the PariPesa games (mostly the slots). Yet, if apart from the entertainment you want to get profits in PariPesa, we suggest you to make a deposit as soon as you register in the casino. By the way, if you verify your account after a registration, you will enable the withdrawals, too. Betway Zambia caters well to Zambian bettors, offering a familiar and convenient platform.

The energy and social aspects of live dealer games are a big draw for many players. Gone are the days of limited options and long trips to brick-and-mortar casinos. Now, with just a few clicks, Zambians can access a vast selection of casino games and thrilling sports betting opportunities from the comfort of their homes (or anywhere with an internet connection!). Melbet emerges as a strong contender for Zambian online casino enthusiasts, especially those who value a wider range of deposit methods, extensive sports betting options, and a variety of bonus offers. MelBet, established in 2012 and fully licensed under Zambian jurisdiction, is gradually becoming a key player in the mobile betting scene in the country. With its app known for its user-friendly interface, it delivers a diverse and engaging experience for sports betting and casino players on the go.

You play against the dealer, and the player with the closest total to 21 wins. Basic strategy charts and guides are readily available online to help you improve your Blackjack skills. However, keep in mind that live betting can be fast-paced and requires quick decisions.

This page offers all the important information on the MELbet promo code for Zambia. MELbet provides new customers with an attractive welcome bonus when they register for an account today. A list of regular promos is also open to both new and existing players, including free bets, profit boosts, and cashback. Premier Bet is one of the proven bookmakers in Zambia that operates in the online market for sports betting and gambling. The bookmaker has an interactive platform that provides a good set of betting opportunities.

MELbet offers generous betting odds on all your favourite sports, including football, horse racing, cricket, boxing and UFC. With the recent updates introduced by Meneer Casino, the online betting landscape is experiencing significant shifts. Experts believe that the adoption of cryptocurrency payments and advancements in mobile technology are game-changers. These innovations are expected to attract a larger, more tech-savvy audience to online gambling platforms. PariPesa is one of the most well-rated crypto bookmakers in the world these days.

I like to read through the details, lurking for an opportunity to maximize my chances of converting bonuses into my withdrawable cash. On the other side, winnings resulting from a free stake will be credited to your account and are usually at your own disposal. Like in all other countries in Africa Melbet works under the global license from Curacao and a special regional regulation by the local authorities in Zambia. You can use our local systems – MTN and Airtel – but there are also possibilities for crypto payments and deposits via e-wallets or e-vouchers. Melbet provides you with the option of anonymous transaction through cryptocurrencies such as Bitcoin.

Further, the introduction of live dealer games offers players a more authentic casino experience, comparable to brick-and-mortar establishments. This feature has already seen a positive response from users, with many praising the interactive and engaging nature of live gaming. Melbet offers a wide and versatile range of banking options in Zambia, making it easy for users to manage their funds. The platform supports Airtel Mobile money along with various e-wallets like Jeton Wallet, WebMoney, and ecoPayz and popular cryptocurrencies such as Bitcoin and Ethereum.

It also inspires investor confidence, especially at a time when Yellow Card seeks to expand into more regions. Yellow Card Financial, the fastest-growing cryptocurrency company on the continent, celebrates exceeding 1 million customers in only three years. The pioneering pan-African company reached 1 million customers in March 2022 and shows no signs of slowing down. Lastly, the sportsbook has a promotion that encourages consistent betting, rewarding participants who place winning bets over an extended period. Bettors can receive free promo codes worth between 94 ZMW and 940 ZMW, depending on the length of their winning streak.

- There’s also an access to the hot Aviator game, virtual sports like soccer, tennis, motto sports and hound races, as well as hundreds of fast racing games.

- Further, the introduction of live dealer games offers players a more authentic casino experience, comparable to brick-and-mortar establishments.

- The Android version of the MelBet app is designed to be fast, robust and easy to use.

- This led to a huge increase in both participation and retention rates.

This showed us that we are on the right track, people value what we are building, and it’s solving a need. Over one million people have trusted Yellow Card, and now it’s our turn to show why it is the number one place for crypto in Africa,” he said. They promote responsible gambling practices by allowing users to set deposit limits and providing resources and support for those struggling with gambling addiction. Popular individual sports like Tennis, Boxing, and Athletics are also available, offering chances to place bets on various sporting events. While Soccer and Cricket remain popular, Betway Zambia caters to a wider range of sporting interests.

In this Zambian casino you can play all types of table games like roulette, poker, blackjack and baccarat, as well as many popular TV show games. This means that instead of real ZMW coins you can invest virtual coins. Just click on the Demo mode button and activate it for some of the best slots in the world, including Big Bass Bonanza, Sugar Supreme Power Nudge, Gorilla Rapid Link, Lucky Cash and Spins and many more. In the PariPesa live casino section you can also discover many TV show games where luck matters more than the skills. Try Sweet Candy Bonanza or Football Studio to diversify your time on the platform. “Every strategic decision we’ve made has always been customer-centric.

Now you can deposit money to unlock the new player offer, as well as to test the soccer bets, the live tennis bets or any of the 2000+ mobile-friendly slot machines. The iPhone and iPad native app for Melbet mobile bets and casino games is expecting you in Apple App Store. The official iPhone market for application does allow real money applications so you will find all the details about the installation process there. Even if placing mobile bets via a mobile browser website version represents you common top preference, the installation of Xsportsbet app worth it just for receiving the mobile app bonus. This bonus is 100% first deposit bonus up to K 40 and it is specially tailored for the mobile application users as there’s another first deposit bonus, which is designed for desktop users. There’s, though, one thing Xsportsbet has been left behind the competition about and it’s in the odds.

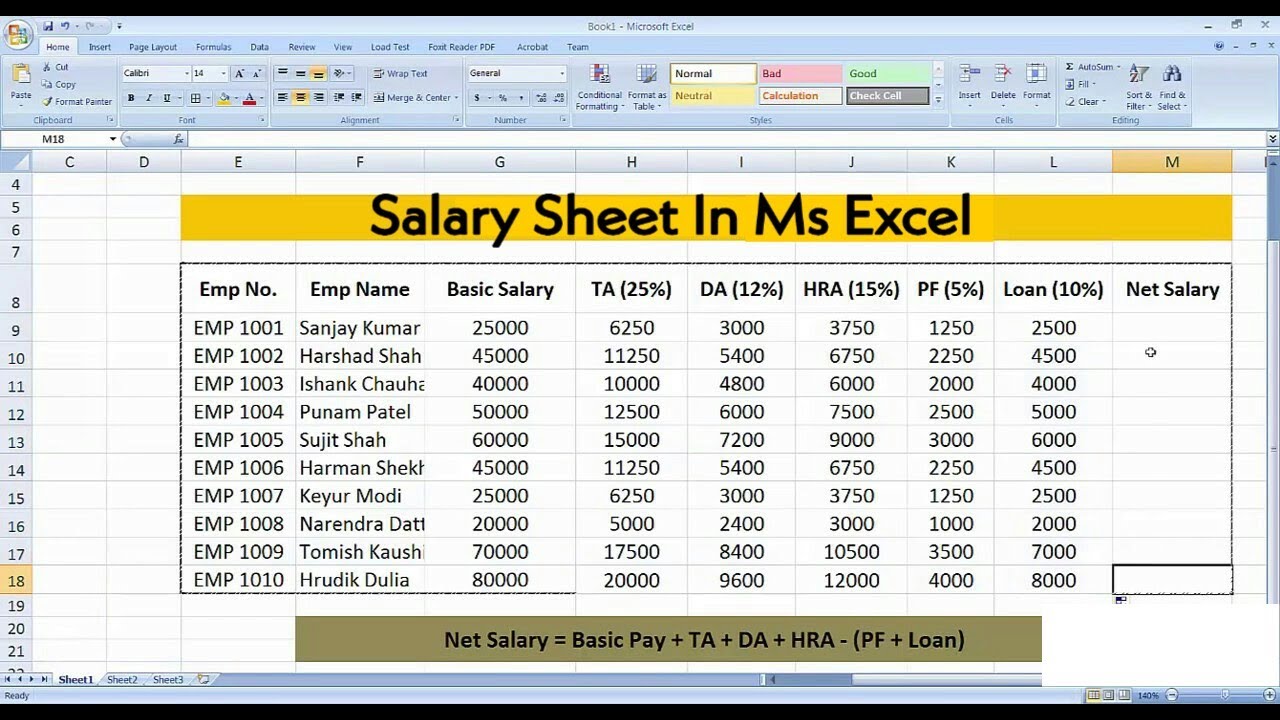

Xsportsbet Zambia registration and deposit via a mobile device

The intuitive navigation, clear layout, and easy access to various sports and casino games make the app appealing to both new and experienced users. The live betting feature is particularly well-executed, providing real-time updates and odds. Melbet’s live casino section takes things a step further by offering a truly immersive experience. Here, you can play classic table games like Blackjack or Roulette with real human dealers streamed directly to your screen. Imagine the excitement of placing your bets and interacting with the dealer in real-time, from the comfort of your home.

If you want to play casino games in Melbet through your smartphone, register via the official mobile website or download any of the available apps – for iPhone and for Android devices. Melbet is a highly rated African bookmaker with a regional website version and three active apps for Zambia. Melbet provides a variety of deposit and withdrawal methods convenient for Zambian players. This includes traditional options like mobile money, credit cards and e-wallets, alongside cryptocurrencies for added privacy. Melbet caters not only to casino enthusiasts but also to passionate sports fans. Melbet offers a comprehensive sports betting platform alongside its casino offerings.

The reliability and the huge variety of offers is 100% guaranteed in this first-class platform for games. Premier Bet online casino offers a very attractive welcome bonus to its players. Everyone who registers in the online casino receives 400% Welcome Bonus on First Deposit.

This ensures you’re playing on a platform that adheres to industry standards and fair gaming practices. A licensed casino is more accountable and offers recourse in case of disputes. While Melbet offers a feature-rich online gambling platform, it’s crucial to remember to prioritise safety and responsible gaming practices.

We’ll also include screenshots and examples to simplify your understanding. It is important to note that while betting is legal, players are encouraged to play responsibly and within their own financial means. Gambling can cause problems with gambling addiction, so it is important to be careful when participating in it. Always check Melbet’s website for the latest offer and thoroughly read the T&Cs before claiming any bonus.

In addition to regular sports betting, you will also be able to place live bets. All the sport bets and the betting extras listed above are added in the application with no exceptions. It was a massive goal that we set for ourselves, and the team rallied to make it happen. Although it was not an easy journey, it has been a very rewarding one.

Popular titles include Dota 2, League of Legends, and Valorant, along with classic favorites like Tekken and Injustice. This diverse selection ensures that all types of gamers and betting enthusiasts can find their niche within MelBet’s eSports offerings. The Know Your Customer (KYC) process is one of the most important aspects of any online betting platform’s security measures. For instance, Melbet Online has strict KYC protocols in place for verifying its users’ identities so as to prevent fraud while adhering to relevant laws and regulations. This involves collecting documents that prove who you are and where you live – only those who meet certain criteria should be allowed access to such platforms.

Betway Zambia Brand Overview

This ensures you understand wagering requirements and other conditions. Numerous regional Melbet apps are listed in the official Apple App Store. So when you search for our local application, do not forget to add the name of our country. When you sign up for a MELbet account, you will need to complete the registration process and make an initial deposit.

We don’t find any reason for you not to register in this Zambian sport betting company, excluding the odds. However, if they are not so important for you, on mandatory make a registration in Xsportsbet. Once you enter this betting house’s website via your mobile device, a banner promoting the company’s app is going to appear on the page. There’s a button on the banner you can directly click on to download the application file. When you become a PariPesa player you can try absolutely all the gaming titles listed in the platform. The payment methods are designed for instant deposits without any fees, ensuring a seamless transaction experience.

Betway live betting services allow you to wager on ongoing matches, with odds constantly changing to reflect the live action on the pitch or court. This dynamic approach adds a new layer of excitement to your betting experience. Betway Zambia has crafted a sportsbook that caters to the passions of Zambian sports fans, offering betting options across a wide range of sports, including the most popular choices in Zambia.

Melbet also offers a unique bonus for placing a total of 100 wagers within a month. It applies to both pre-match (single and accumulator) and pre-match+live bets (accumulator), excluding live single bets or accumulators with only live events. Soccer, undoubtedly the king of Zambian sports, takes center stage at Betway Zambia. They offer a vast selection of betting markets to satisfy dedicated football fans. You can bet on the outright winner of a match, the final score, or a particular player or team to break the deadlock (First Goalscorer).

Another special offer available to Zambian players is the daily acca deal, which involves a selection of the most interesting events combined into several accumulators. Additionally, there is a 100% refund offer on accumulators where only one bet loses, provided that the accumulator has seven or more selections with odds of 1.70 or higher. The platform boasts a user-friendly interface, making it easy for beginners to navigate and place bets. Support for the Zambian Kwacha (ZMW) streamlines the betting process, avoiding unnecessary currency conversions.

PremierBet offers decent odds and interesting promotions, which are defined by experts as quite competitive in the market at the moment. To start playing real money casino games make a PariPesa deposit via crypto, Visa, Jeton, Perfect Money or other available Zambia payment method. Most of them are in a real dealer mode which means some really exciting experience with croupiers that will help you orient in the game rules and will guide you through the entire gameplay. The platform boasts an impressive array of games, covering genres like sports simulators, strategy games, card games, and more.

After this, setting up a secure password and agreeing to terms and conditions is standard. No matter what type of a phone you have, if it’s smart and with stable internet connection, use it with no concerns or hesitations to register in Melbet. If you have a desktop account in this online betting operator, you don’t need another one to place bets and play games from a mobile device. Our team of sports betting experts advises how to get and use each bonus available at MELbet Zambia. Click any link on this page to register for an account, make your first deposit, and bet to get your welcome bonus free bet.

Such kind of growth will not only maintain current users but also attract new ones who want more immersive experiences beyond mere transactions during wagering activities. Once registration is complete, submitting KYC documents becomes the next crucial step. Typically users are required to provide proof of identity (POI) and proof of address (POA). POI can be any government-issued ID card like a passport or driver’s license, while POA can be a recent utility bill or bank statement, etc. The user needs to upload clear photos or scans of these documents through the app.

With its user-friendly design, extensive range of options, and robust security measures, it stands out as a top choice for Zambian bettors. Whether you’re an experienced bettor or new to online betting, it provides a convenient, versatile, and secure betting environment. In terms of betting types, Melbet stands out with the long roster it provides in Zambia. Local bettors can engage in European handicaps, correct score predictions, and over/under bets, among others. Social integration in mobile betting apps comes with many opportunities for improving user engagement and retention but also poses some challenges.

Melbet also offers live betting options, allowing you to place wagers on ongoing matches. This adds an extra layer of excitement as you can react to the flow of the game and potentially capitalise on changing circumstances. They attract customers worldwide with bettors using their mobiles and desktop computers to place bets and access promotions.

Privacy is one of the major concerns because individuals are not comfortable with the way their personal information or gambling habits may be handled. Moreover, it is important to have an equal user interaction that does not allow experienced bettors to dominate while at the same time creating a friendly environment for beginners. Therefore, platforms like Betting Melbet need to carefully navigate through these obstacles so that they can fully exploit the benefits brought about by socializing while ensuring safety within such sites. Betting apps are starting to include social features that not only make the game more fun but also help build communities among users.

This free entertainment is identical to real money gaming activity, but your bets are placed in virtual credits. Of course, the officially registered customers have an access to the demo mode, too. Communities within mobile betting apps have several benefits that enhance user experience. They provide a space for socialising beyond traditional betting activities by fostering discussion, friendship and shared experiences which can lead to better-informed bets. Members can share tips and advice, improving their strategies through collective wisdom. Moreover, such communities increase user retention rates as they foster belongingness and competition among peers thus making gambling more than just an individualistic pursuit.

The platform also supports mobile betting, enabling users to place bets and follow games on the go. This level of accessibility makes MelBet a convenient choice for betting enthusiasts in Zambia. The registration process on a mobile betting app begins with downloading the app and selecting the sign-up option. Users will then be asked to input basic personal information such as name, date of birth, and contact details.

Betway Zambia offers a compelling platform for Zambian bettors, catering to beginners and experienced users. When you register and make an initial deposit in Melbet you will also get a set of 290 free spins, but only if you have selected the casino welcome bonus rather than the sports promotion. The majority of the online Melbet slot machines are made by leading providers such as Microgaming, Amatic, Spinomenal, Mancala Gaming, Push Gaming and KA Gaming. We, though, believe that you will easily disocver titles made by your favorite developer, too, because the company is a partner to 20+ popular names from the industry.

These platforms allow bettors to connect with each other, share insights and bet together, creating lively betting communities that keep people engaged with the app. Mobile betting is going through a major transformation as social features are being introduced into the system. This has turned betting from an individual activity to a communal one where people can easily connect with each other using apps such as Melbet Uganda. These platforms have become more than just places for placing bets; they are now spaces for interaction and engagement too. The integration is made possible by among other things the seamless Melbet Uganda app download which makes it easy for users to access them. This efficiency drive, coupled with security consciousness, is what will keep mobile betting platforms growing steadily over time.

Refunds on accumulators are open to both new and existing MELbet members. To bet on MelBet, you don’t really have to download the app as you can opt for the mobile-optimized website. The version retains all functionalities of the main website and is designed to adapt to different screen sizes, ensuring a user-friendly experience on smartphones and tablets. Meneer Casino, one of the most renowned names in the online gambling and betting sector, is making headlines with its recent innovative initiatives and updates. This article will delve into the latest developments that are setting new standards in the industry. If you are having difficulty with the betting process or just need information, you can contact the customer support team of Premier Bet via website contact form.

Betway Zambia offers a casino section with various slots, and table games, including a Live Casino section where you can play against real dealers in a virtual setting. The slot machines are commonly in the focus of an online casino and Melbet is not an exclusion from this basic rule. You can expect up to 2000 different games here, including with themes such as fruits, mystery, Egypt, Greece, sports and many more. Whether you prefer 3-reel or 5-reel games, you will find them in this huge collection with low, middle or high volatility.

Once verified successfully, users become fully enabled to deposit funds & place bets, thus ensuring compliance with all regulatory requirements for legal betting. Unlike the web-based app any native app is supposed to be downloaded and installed to appear in a device home screen. To do so with Melbet you need to find the apk directly in the company’s mobile website as there’s no real money app in Google Play Store, so this bookmaker’s native app isn’t there, either. The iOS version of the MelBet app maintains the same functionalities as the Android app. It is available for download from the Apple App Store, ensuring a secure and straightforward installation process.

Their 24/7 live chat feature allows for immediate help, addressing queries efficiently. For more specific concerns, Melbet Zambia provides dedicated email addresses for general queries, technical support, and security issues. Additionally, there’s an option to write directly to Melbet Zambia via their website.

This led to a huge increase in both participation and retention rates. These cases show how integrating social components can turn betting from something done alone into an exciting shared activity. MelBet stands out in the country with its comprehensive selection of live and pre-match eSports betting options. The dual approach caters to various preferences, allowing users to engage in real-time action or place strategic bets before events commence. The live betting experience is particularly immersive, offering the thrill of instantaneous decision-making as the gaming clashes unfold right in front of your eyes via free live streaming.

A notable start is the 200% bonus on the first deposit, capped at a maximum of 4000 ZMW. To qualify, all that the bookie requires is to complete your profile and fund it with at least 26 ZMW. Just bear in mind that the bonus must be wagered twelve times in accumulator bets.

The slot games section is particularly noteworthy, showcasing an impressive range of titles from esteemed developers like Barbara Bang, Smartsoft, Spinomenal, and Wazdan. Zambian players can find popular games such as Sweet Bonanza and Book of Truth, each offering a unique thematic and gaming experience. Moreover, the platform’s user-friendly interface allows players to easily browse and select games based on their preferred developers. Betway Zambia offers various customer support options for user convenience.

The welcome bet bonus offers to double your first deposit, up to ZMW1000. In order to use the bonus, simply wager the full value of the first deposit. Find these offers in the Live casino section where, by the way, you can also try the available TV show games where not skills, but your betting strategy and luck are more important to earn some cash. By all means in this website you will find hot games like Prime King Riches of the Ancient, Winning Clover 5 Extreme, Patric’s Magic Field and Dwarfs Fortune Hold the Jackpot.

With this detailed review, we will introduce you to the app, helping you run it on your Android or iPhone in order to start wagering on the fly in a snap. The introduction of social features in mobile betting apps has changed the way people bet and their overall experience. This means that when they use these platforms, they become part of a more active and knowledgeable betting community. They usually make use of collective insights to make better decisions, which increases their chances of winning as well as deepening their understanding of how betting works. By making the environment interactive where bettors are not only participants but also contributors to the content of the platform, social integration within betting apps greatly enhances user engagement. This approach increases both the time spent on the app and enriches one’s betting experience.

As a casino company Melbet succeeds in attracting players with different tastes and preferences. The huge collection of gambling genres makes it possible for the Zambian operator to become one of the local leaders in the online industry. If you are interested in the betting house’s igaming products, don’t hesitate to read our today’s review below. Typically, the process of registering and completing KYC on a mobile betting app involves a few streamlined steps. These steps are designed to be quick and user-friendly so that new users can start betting as soon as possible while still adhering to necessary legal and security standards.

Picking a single operator as the best is simply a matter of choice and taste. You are welcome to visit our list of selected Zambian bookmakers and pick your favourite one. And user experiences may vary regarding response times and the quality of assistance provided. It is free of charge and you will not pay either a monthly subscription or a one-time price to have it in your smartphone.

This includes live chat, email, and a phone number specifically for Zambian users. As a player, you’re free to choose your preferred method of communication. Overall, Betway is making it easier for Zambians to access and play various thrilling sports betting and casino games. Existing customers will be offered different types of loyalty offers and betting bonuses at online bookmakers in Zambia. Bookies use this offer as a sign of appreciation for players who have been loyal to a certain brand.

Just like its Android counterpart, the iOS app offers a seamless betting and gaming experience. The other offline options for a deposit are the Touch4Pay ATM and paying in cash to any of the bookie’s representatives. Poker is by the way represented by the live casino providers working in a close relationship with PariPesa, too.

For example, Melbet Online uses these social tools to keep its users informed and engaged thus improving satisfaction levels as well as retention rates among them. Group betting initiatives coupled with options for sharing socially turn an app into a social network where people interact around games making every bet unique and interesting for all involved parties. When it comes to mobile betting apps, having a streamlined registration process is key if you want people to sign up and stick around. MelBet’s mobile app in Zambia presents a comprehensive platform for sports betting and casino gaming.

You might also find Video Poker variants that combine elements of slots and traditional poker. Blackjack is a popular choice for its blend of simplicity and strategy. The goal is to get your cards to total as close to 21 as possible without going over (busting).

At the bottom of the operator’s website you will see the Android button. Do not click on it before you allow the download via unknown sources, because the process will not start. The installation does not start automatically after the downloading is completed. This way of registering an account in Premier Beth is extremely simple and fast. All you have to do is send an SMS with the short text “Join” to the number 90170. These two main transactions on the site can be done by phone via crypto currencies, debit and credit card, Jeton or an e-wallet like Skrill, Neteller, Perfect Money, etc.

The sportsbook is particularly notable for its breadth and depth, encompassing more than a thousand daily events across a multitude of sports. Betway Zambia promotes and prioritizes responsible gambling practices, offering users tools and resources to maintain a healthy approach. Bookmaking activities in Ghana are popular among betting enthusiasts, especially in the field of sports betting. However, it is important to comply with the laws and regulations set by regulators to avoid unpleasant consequences.

We’ve advanced key efforts to localise content and engage with customers at events and activations to essentially meet them where they are. From a product perspective, we have allowed our customers to use their local currency to buy and sell crypto. Our strategy to educate customers on cryptocurrencies, combined with the tenacity of the team, are the key factors that helped us reach this milestone. Melbet’s casino is renowned for its vast array of gaming options, offering a game library of over 3,000 titles in total.

Melbet, established in 2012 and accepting punters in Zambia since 2020, has become a recognizable name in the online betting and casino industry. Headquartered in Curacao and operating in the country under a gaming permit issued by the Betting Control Board, the sportsbook offers a secure and comprehensive experience. Already boasting over half a million active players, its extensive sportsbook keeps attracting new players with a wide array of sports, as well as betting on virtual sports, e-sports, and greyhound racing. Football enthusiasts have the opportunity to bet on major leagues from Europe and beyond, alongside local leagues such as the Zambia Super League. The bookie further offers a lot of games of luck and bonuses, which paired with the seamless and robust platform make it worth checking out.

You’ll find Rugby and other betting markets for domestic and international matches, allowing you to back your favorite teams or test your knowledge of the global scene. I think the bonus program provides a solid foundation for new and loyal users, but there’s room for improvement. I think Betway has great potential for even bigger welcome bonuses or a loyalty program to promote adoption. Let us walk through the entire Betway journey, from registration to depositing, betting, and withdrawal. We’ll highlight the key features that make Betway Zambia a top choice.

However, remember to prioritise responsible gambling, thoroughly review bonus terms before claiming, and verify licensing information for a secure and enjoyable gaming experience. The first thing you should do is to look at the top right corner where there’s a small icon with a human face. When you press on it you will not see a button for registration, but instead, you should open the button called Login where the big green button Register will finally appear. On the other side, those of you who own other smart devices shouldn’t discourage as they can use the mobile website version. Even though not as beautiful as the application is, in our personal opinion, the usability level of the browser version is equal to the one of the app. John Colson, Chief Marketing Officer at Yellow Card, says this achievement no doubt strengthens the company’s brand on the continent and trust among current and future users.

Convenience is at the core of the Betway Zambia mobile app (You can find download instructions and compatibility information on the Betway Zambia website). The minimum deposit amount and processing times can vary depending on the method. Mobile money deposits will allow you to deposit K1, but ensure you have at least a K5 to be safe. MightyTips will give their best to find the most trusted and reputable Zambia betting websites which offer best free bets.

Betway Zambia offers different ongoing promotions to keep their existing players engaged and rewarded throughout the year. The exact details of Betway’s welcome offer may change with time, so it’s always best to check the website for current information. In Melbet you can choose between 2000 slots, as well as live dealer games, Keno, Bingo, Tote and other number games, Fast games like Aviator and many more. MelBet’s strength lies in its wide coverage of tournaments and gaming events.

There are many amazing extra products to try if you are keen in online gambling and have a Melbet account. For instance, you can predict events from videogame contests in the ESport section. Place a sportsbook accumulator bet with odds of 1.7 or more and get your stake back in full if your bet loses by just one selection.

There are many examples of mobile betting apps that have successfully incorporated social features to create a sense of community among users. For instance, one platform added live chat and social feeds so that bettors could talk about strategies and events in real-time. This change alone caused engagement rates to skyrocket; daily logins went up by an order of magnitude, and people were interacting with each other more than ever before. In another example, a fantasy sports platform introduced community leagues where users could compete against each other within the same environment.

The live casino boasts popular games like Live Roulette, providing players with a real-life casino experience. It is a popular way for some of the best betting apps to attract new customers. They allow you to place wagers without having to risk your own money. Such offers are very rare but can be an important factor in deciding which online bookie to use.

When you open an account you become an official member of the PariPesa casino community. With this action you get many rights, including playing games with real money, depositing cash, cashing out your profits and you name it. Melbet offers multiple support venues in Zambia, ensuring users have access to assistance around the clock.

There are several common ways in which bookies provide stakes for free. Let’s quickly go over some of them, so you can start getting your free bets today. If you find yourself struggling with gambling addiction, please seek help. Every betting site has resources available to help you regain control of yourself. This ensures a diverse selection to cater to different player preferences.

Melbet presents itself as a feature-rich online gambling platform catering to Zambian players. They offer a vast selection of casino games, extensive sports betting options, and a user-friendly platform. The welcome bonus and ongoing promotions can be enticing for new and existing players.

Above, we’ve gone through the best options for free bets Zambia in 2024. Refer to the list of these options in order to get the best option for you. Navigating through MelBet’s eSports section is a breeze, thanks to its user-friendly interface.

The most classical way to connect to a mobile bookmaker is by entering it through your phone browser. You will quickly find an access whether via Google Chrome, Mini Opera, Firefox or any other browser you prefer. You can deposit funds instantly to your MELbet account using your bank card or e-wallet.

The Melbet mobile app offers a well-rounded betting experience for both Android and iOS users in Zambia. It features a range of services from the desktop version including live and pre-match betting, a live casino, TV games, bingo, and eSports. The app is designed with a user-friendly interface and an appealing visual layout, making it easy to navigate and place wagers on global sports events. For Android users, the app is lightweight and doesn’t consume much memory, while iOS users can easily download the app from the official website or App Store.

That’s why companies like Melbet have made their registration processes so simple. They’ve even introduced the Melbet APK to make it even easier – just download and start betting. This focus on accessibility means that users don’t have to wait around before they can start playing, which shows a dedication to customer satisfaction as well as platform efficiency. This licensed in our country website offers you mobile sports bets for matches from nearly 30 different disciplines, including virtual sports and eSports.

Speaking of which, in this gambling house there are slots with ordinary fixed jackpots and progressive types, which offer a constantly increasing final prize for the best casino lovers. If you’re a mobile addict like me, you’ll be glad to know that Melbet offers a convenient mobile app for both Android and iOS devices. This app allows you to enjoy all the thrills of Melbet from anywhere with an internet connection.

Bookmakers still have to make money, however, and such offers might not be available at all bookmakers in Zambia. As a result, the players should always make sure to check this before signing up with a betting site. The future of social betting appears bright since it could change how people relate to different betting sites. In this regard, interactive elements aimed at fostering community-based betting environments are likely going to take centre stage as these platforms continue evolving.

Once your Betway account gets verified, you can fund your account with convenient deposit methods available for Zambian players through the platform. Overall, you just go to the deposit section and choose your channels. Betway automates mobile money uploads, and all you have to do is just enter the amount and let the app send a prompt for you to approve on your phone. The platform is easy to use, and user-friendly, you can register your account in under 5 minutes, depending on your internet speed. Once you create your account, you get instant access to an extensive range of betting options. A free bet without a deposit can be a useful incentive for new players.

This extensive coverage not only provides varied betting opportunities but also keeps users engaged with the latest in eSports happenings. ESports has transcended its niche status to become a mainstream phenomenon, captivating audiences worldwide. MelBet has recognized this trend and is offering an extensive eSports portfolio to its customers in Zambia. If you want to know more about it, this review delves into the diverse array of options available.

Having responsive and helpful customer support is crucial for any online casino. If you encounter an issue while depositing, playing games, or withdrawing funds, you want to get assistance quickly and efficiently. Downloading the Melbet mobile app is a great way to enhance your online gambling experience in Zambia, offering flexibility and convenience right at your fingertips.

It should be just as useful to seasoned gamers as to novices, helping you make up your mind on whether the bookie should be your next betting destination. Melbet boasts a massive casino library featuring thousands of slots, table games, jackpots, and live dealer titles from various renowned providers. If you used to play Bingo games in physical gaming rooms, now you can try them in the internet and on the go via this Zambian casino app. There’s also an access to the hot Aviator game, virtual sports like soccer, tennis, motto sports and hound races, as well as hundreds of fast racing games.

After downloading it, you need to click on the file to start its installation. Note that you may need to allow the installation through your smartphone settings. Peter Mureu, Marketing Director at Yellow Card, says every decision made has been for the benefit of their customers, reaching far and wide across the continent. Look out for sports or events where Betway Zambia might offer Acca Boosts.

In a specially tailored Melbet Zambia page the technical requirements are listed – the minimum MB you should have in your disc space, as well as the required OS version (12.00 or a newer). In conclusion, Meneer Casino is swiftly adapting to the ever-evolving landscape of the online gambling industry. By implementing cutting-edge technologies and placing a strong emphasis on user experience, Meneer Casino is setting new benchmarks for others to follow. Stay tuned for more updates and innovations from this industry leader. Xsportsbet will accept you as an official customer on the platform once you fill in the company’s registration form. Once you fill them in, click on the button Register, which this time is coloured in orange.

If you’re looking for a feature-rich online gambling platform in Zambia, Melbet is a strong contender. However, it’s important to manage your expectations regarding customer support and thoroughly review the terms and conditions of any bonus offers before claiming them. Melbet is a popular online betting platform offering a vast array of features for casino enthusiasts and sports bettors alike. Whether you’re a seasoned gambler or a curious newcomer, Melbet has something to entice you. With an official Melbet app and an account in it you become a client with many rights and options to choose from.

“We have only seen the start of the impact crypto can have in Africa, from job creation to breaking down borders. Over the next few years, we will continue to see innovative ways crypto is used to solve everyday problems,” added John, Yellow Card’s Chief Marketing Officer. With 1 million customers reached, there is much more ahead for Yellow Card in 2022. Since launching in Nigeria in 2019, Yellow Card has dedicated its efforts to providing financial inclusion and freedom for all Africans. The company expanded into four new African territories in the last year alone, increasing its total country presence to 16. All financial transactions get processed with industry-standard encryption technology to safeguard personal and financial information.

User Experience

To get your new customer bonus, simply use the 50SPORT promotional code to get a 100% bonus on your first deposit. You must use your first deposit on odds not lower than https://1wincameroun.net/ 1.65 within 30 days. The bonus must also be used on selections with odds equal or higher than 1.65.

For those who enjoy strategic gameplay, Melbet offers a selection of classic table games like Blackjack, Roulette, and Baccarat. These games have been around for centuries and continue to be a source of entertainment and challenge for casino enthusiasts. Find out how to download, install and register in this betting app from Zambia safely and permanently to receive a 24/7 access to a large gambling assortment of services.

Choose from the day’s standout accumulators for top-tier sports events and enjoy a 10% uplift in odds when your selected Accumulator of the Day wins. Log in, arrange your accumulator, place your bet, and you might just revel in victory. Sign up at MelBet and grab an outstanding 200% bonus on your first deposit, with the potential to earn up to 5200 ZMW! Just complete the sign-up procedure, fill in all the mandatory account details, and deposit to enjoy this introductory offer. You can download the Premier Bet app for Android either from the Google Play Store or directly from the bookmaker’s website.

This betting house’s odds are not among the lowest odds provided in Zambia, but they are certainly not close to the highest ones. For those seeking the thrill of real-time gaming, Melbet’s live casino won’t let them down. The section is powered by reputable providers like Atmosfera, Vivo Gaming, and Fazi, bringing the authentic casino atmosphere to players’ screens.

Betway Zambia offers an exciting jackpot option called the Yabonse Jackpot. This customizable jackpot allows anyone to tailor participation and potential winnings. Imagine the thrill of placing a bet just before a crucial moment in a match.

Ensure that you understand all wagering requirements attached to the welcome bonus. These requirements specify how much you need to wager your bonus funds (and sometimes even your deposit amount) before they can be converted into withdrawable cash. Licensed bookmakers can provide betting services on sports events, horse racing and other forms of gambling in accordance with the law. They are also required to comply with certain rules and regulations set by the regulator.

It’s been making a great impression as a casino service provider, too. Recently the company has started appearing in numerous African countries. Slot, poker and other casino game enthusiasts who are of a legal age are welcomed to register. Find out how to do so and what you will get when you become this operator’s official player 100% for free.

Of course, local punters can also utilize traditional banking methods like credit cards. Live betting is a significant feature of Melbet, available around the clock, and also providing Zambian users with free broadcasting. The live betting option is also comprehensive, offering over 30 markets for most sports, and includes dynamic bets such as corners, yellow cards, and free kicks. Betway Zambia shines with a wide range of popular Zambian sports betting options, ensuring users can find their preferred wagers. This, combined with exciting promotions, keeps the betting experience engaging. As a visitor in Melbet with no active account you can play many of the available games.

MELbet will match your deposit up to 200% and these additional funds can be used on any sporting event. For Android users, the app requires an operating system of Android 4.1 or higher. This makes it accessible to a wide range of devices, including older models. IOS users need to have iOS 12 or higher to ensure optimal performance of the app on Apple devices.

Their sheer variety, ease of play, and potential for big wins make them a favourite among many players. With themes ranging from ancient Egypt to futuristic adventures, there’s a slot title to suit every taste. There you can place a bet on a specific match or sport and monitor its results online.