- 4D: Nation musician Axton (HOYT) – rarely here, somewhere, for the margins of my brain. As to why?

- 7D: Sodium hydroxide, to help you chemists (NAOH) – if it’s not NACL, Really don’t like to see they ’til later in the month.

- 11D: Volcanic productivity (MOLTEN LAVA) – it, and its own symmetric similar Dont Rush Me, I really do indeed such as for example. Here. Personally i think greatest.

Fannie mae

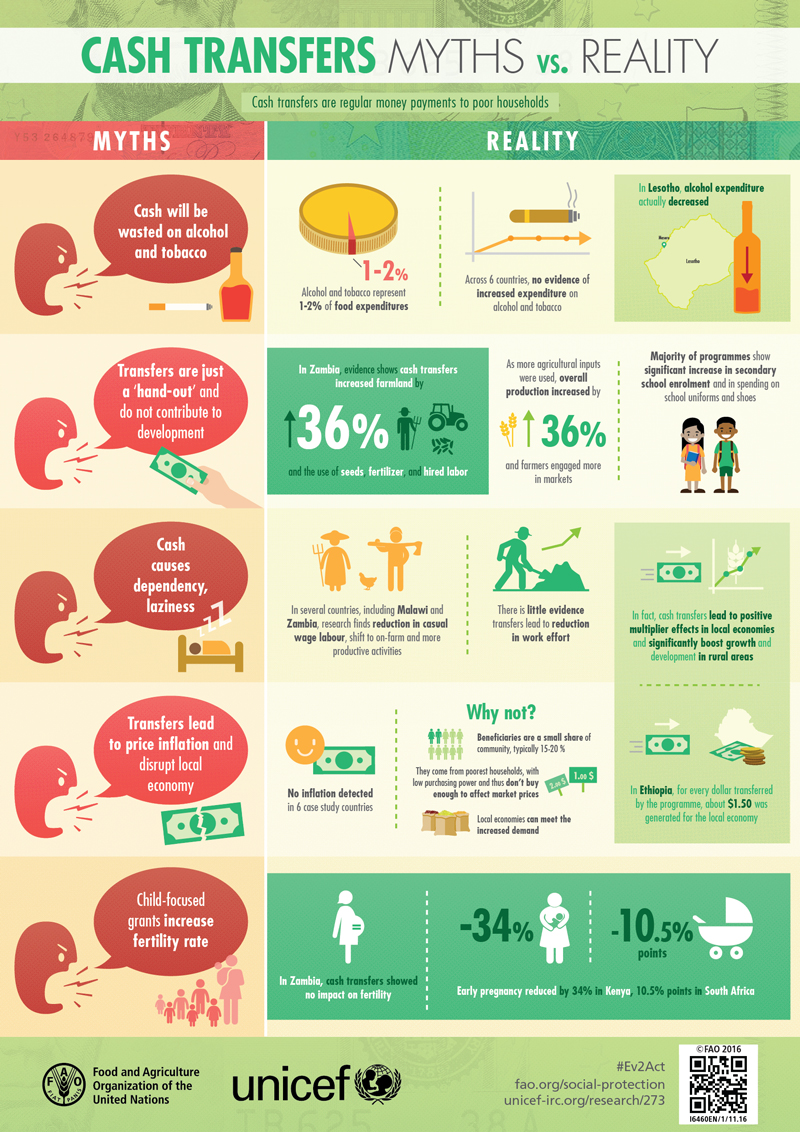

THEME: On the Mud – around three motif responses avoid which have terms “Regarding the Soil,” “In the Earth,” and “Regarding the Dirt,” respectively

I do want to become type, but i have the truth is: I do believe this can be probably one of the most improperly created puzzles I’ve over all-year. The newest responses FNMA ( 47A: Low-prices mortgage org. ) and INNYC ( 41D: Where MoMA is actually ) try practically unforgivable in any puzzle, aside from an early on-few days mystery. The fact it intersect merely dirt icing to your mud cake. You can see how it happened. The fresh grid are shagged about rating-go, as the theme solutions immediately force you to the an “I—C” state, and all sorts of the brand new decent answers that may complement indeed there make you a terminal “I” or “A” for the 52A answer Missouri installment loans. Continue reading Taylor Dayne – Don’t Hurry Me (Specialized Songs Videos)