Illustrate that you have a stable earnings

You’ll be eligible for a mortgage as much as possible build regular money, whether or not operating otherwise thinking-operating. While the a home-operating debtor, showing you have an established source of fund would be many crucial planning.

Bank statements and you will tax statements are a couple of well-known an effective way to prove their secure financial channels. It’s important so that you might prove your money that have good files.

Create your money history readily available

Very home loan people would like to see your income background for no less than during the last 12 months. For the suggestions, lenders will feedback your own taxation return.

Change your method of ensure you have a taxation return you to suggests a strong net income, particularly if you can be found in the newest habit of using much out of develop-offs.

Financial comments is actually a different way to prove your economic origin. Loan providers constantly inquire about doing 24 months’ property value bank statements in order to calculate your own average month-to-month income. This might be based on dumps changed to your bank account.

Create a huge down-payment

Lenders essentially view you as the less of a danger for folks who generate a huge down payment because in that way, there will be reduced personal debt to repay. The monthly mortgage repayments was lower, and you can reduce money borrowed if you standard. Which have a deposit of over 20% might also save you of having to pay individual mortgage insurance.

Not only can an enormous downpayment enable it to be easier for you to qualify for a mortgage, but it can also make you accessibility most readily useful words instance straight down interest levels.

Get ready all your financial data

The mortgage professional you are handling enables you to see and that financial documents you ought to bring. While it can vary, financial comments and you may tax statements try most asked. Check if you have those in helpful. Otherwise, have them immediately.

Since thinking-functioning homebuyers generally have more complicated resources of money, they should dig deeper. Hooking up your accountant with your bank is a sure way of accomplishing they otherwise providing a great deal more proof income.

You will need to save

This is not a necessity however, rescuing larger helps you once you apply for home financing. If hardly anything else, it can give you far more selection including decreasing the count of obligations you take toward by creating a large advance payment.

How do i show worry about-operating earnings to own a home loan?

To show worry about-employed earnings having a mortgage, you ought to give a track record of uninterrupted notice-a career income for around two years. Really financial banking companies otherwise organizations can look for the following:

Employment verification

A position confirmation will help you to prove that you is worry about-employed. The easiest way to get employment confirmation should be to inform you characters otherwise emails from all of these offer:

- current customers

- authorized authoritative private accountant

- top-notch organizations that will make sure their membership

- Doing business Once the (DBA)

- insurance coverage to suit your needs

- any company otherwise county licenses you hold

Income papers

You happen to be one-step nearer to getting recognized getting a great financial when you yourself have income documentation. Most loan providers require these records:

- individual tax statements

- profit-and-loss comments

- financial comments

Is-it better to be applied otherwise notice-useful home financing?

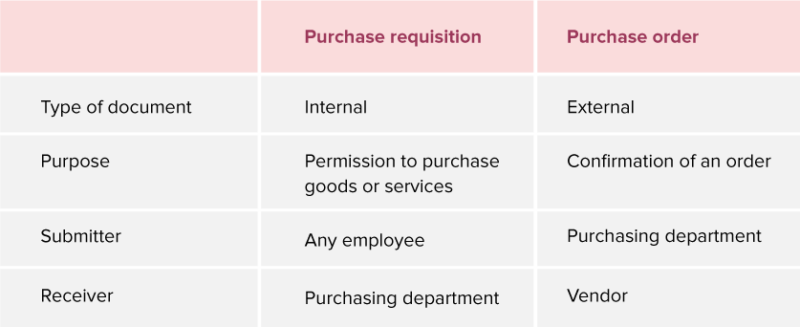

Out of a mortgage lender’s perspective, it is simpler to influence debt status while working unlike care about-functioning. Let me reveal an easy summary of operating individuals and you may mind-functioning borrowers:

Operating mortgage

An employed debtor typically has a Canaan loans developed salary with their company and that’s effortlessly able to produce a position verification and you will income paperwork. Loan providers utilize this recommendations to decide how much cash income the brand new debtor have to build to repay the mortgage.