Just what are a few of the benefits of investment having a marine, Camper otherwise aircraft particular financial?

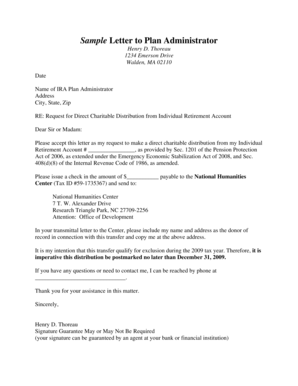

Gather Monetary Advice

- Earliest information get together regarding the potential purchase

- We help you organize the required economic guidance into banking companies

- The teams often internally opinion and you may compare to the detailed financial pool recommendations

Collateral Choices and you can Financial Approval

- Introduce bank book worth and choose the perfect lender to complement your requirements

- I submit the fresh consult towards the lender to have acceptance and track it’s improvements from inside the underwriting

- I get the approval terms and conditions from the financial and you can romantic and when you happen to be able

Document Finalizing and you will Resource

- I participate a title service to do the brand new lien looks and you may ready yourself this new import ownership documents for you.

- I get ready all the bank’s loan data files in your community, thus there’s no wishing for the financial

- Above all, we complement together with your seller otherwise representative to make sure a delicate closing procedure.

Faster Behavior: ecause the brand new iliar into device, there is absolutely no time shed when you look at the wisdom what they’re lending towards the.

Lower down Costs: Most finance companies want twenty-five% upon larger-pass items. Our very own lenders give factors requiring only fifteen% bucks, or trade guarantee regarding transaction.

As to why consider the pre-recognition process?

When you take this new initiative to locate pre-accepted, youre placement yourself to end up being a well-licensed buyer to manufacturers. When you discovered the pre-acceptance away from Credit Lovers, there will be the flexibility out of a funds client as you know how much you are acknowledged having. So it from inside the-hand equipment gives you the capability to negotiate given that with certainty since the the cash consumer.

Another great cause to track down pre-acknowledged is securing in the present interest levels. In an actually ever-switching age your loan recognition commonly guaranty their rates. Extremely approvals are great for thirty day period ever since of application.

Finally, perhaps one of the most important reasons to rating pre-accredited would be to influence the borrowing from the bank restrictions. Of numerous boat finance companies are only wanting how much they can loan your despite what you can do to settle. It is not a long-name means that’s practiced loans with no credit check Hawleyville at Lending Associates.

Tax Deductibility of great interest on the Ship Loans:

Interior Cash Password (IRC) section 163 (h) (2) states that an effective taxpayer will get deduct one certified appeal with the a qualified household. Licensed houses is recognized as a main household (e.grams., a primary family) and one other house (as well as next house) belonging to the new taxpayer with regards to deductibility into tax 12 months. IRC part 163(h)(3) defines certified residence focus just like the people focus repaid or accumulated during the latest tax year on the order or household security indebtedness relating to virtually any accredited home of your taxpayer.

Considering IRC area 163(h) (4), a boat will be believed a qualified household when it is one of the a couple of residences selected from the taxpayer to have aim regarding deductibility in the tax seasons. A professional house need to have earliest way of life rentals along with sleep space (berth), a bathroom (head), and you can cooking business (galley). If for example the vessel is even chartered, the fresh new taxpayer would have to make use of the ship for personal aim to possess possibly more 2 weeks otherwise ten% of number of months inside the year brand new ship was in reality hired, so you can qualify for the attention deduction relative to IRC section 280A(d)(1).

Form 1098, granted by the lenders, is not needed so you can claim the latest licensed desire deduction. According to Internal revenue service directions for Plan A great, function 1040, if your taxpayer will not located mode 1098, allowable mortgage appeal will likely be stated in line 11 rather than line ten with the Agenda Good.

Credit facing a keen unencumbered home to pick an effective next household motorboat possess restrictions. Real estate loan attention deduction is bound so you’re able to notice reduced on the financial debt familiar with buy otherwise improve a home, or perhaps to refinance the remainder harmony to your a buy or upgrade. If your money isn’t used for the house, the attention expense does not qualify for the fresh deduction.

Focus paid back on a home security mortgage to find a boat and is almost certainly not deductible. Mortgage loan attention deduction is bound in order to attract paid off into home equity fund to $100,000. That with a home collateral financing, your ount interesting that is deductible, if the a yacht mortgage balance is higher than $100,000.

Borrowing facing an inventory profile to order a boat produces complications in regard to notice deductibility. Next home loan focus deduction is restricted to notice repaid towards second property that will be secure by you to 2nd domestic. A composed collateral agreement (defense agreement) off a broker showing the fresh new boat due to the fact collateral is an activity agents aren’t inclined to provide.