Are there closing costs that have an FHA Improve Re-finance?

FHA Streamline Re-finance Closing costs

Most homebuyers and you can refinancers understand how to compare interest rates anywhere between various other loan providers, however, many mortgage customers don’t think as often in the closing costs and you may fees.

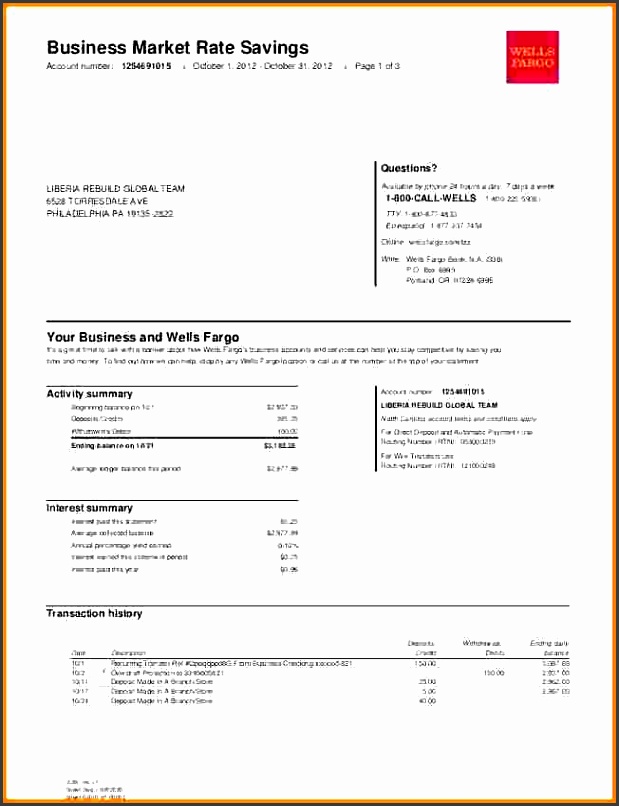

Closing costs can differ a great deal by financial, as well. Certain charge are set within the brick, however, anybody else are not. Instance, mortgage origination charges may vary out-of 0% to 1% of the loan amount. If you’re refinancing an effective $2 hundred,000 loan, 1% manage incorporate $2,000 in closing will set you back; 0.5% carry out add only $1,000.

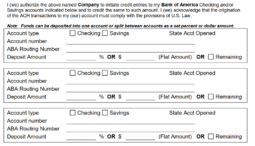

What is the simplest way to compare closure fees? Rating Loan Quotes out of no less than several lenders. The FHA lenders’ Loan Rates will be appear on a standardized function, while making this type of costs easy to examine.

FHA Improve Refinance fund is actually faster, simpler – and less expensive – than most refinance fund. Nonetheless however want settlement costs.

Whatever refinance tend to sustain closure fees. Even if the bank promotes zero closing costs, the expense remain, and most often, they’re nevertheless becoming paid back of the debtor finally – unless you discuss, especially, for your FHA financial to reduce its fees.

Although you pay settlement costs, the huge benefits can invariably outweigh the expense in the event your the financing preserves currency each month.

Normal closing costs having an FHA Streamline Re-finance

Also the costs here, being qualified consumers are needed to prepay particular costs for example taxes and you can homeowners insurance. The new borrower’s newest bank generally directs a refund away from a similar matter when the mortgage shuts. This means the web based rates to own individuals often is alongside zero having prepaid situations.

*This really is a summary of you are able to charges getting an FHA improve refinance. Whilst not a nearly all-comprehensive record, it has to leave you an idea of general settlement costs.

The loan you can expect to want highest or down fees according to financial, the mortgage loan places Kiowa amount, as well as your credit rating certainly one of almost every other financing circumstances. The only method to rating an exact guess is to find a loan Imagine from a loan provider to see the cited costs. When you are getting which estimate regarding at the least two loan providers, you might start to discuss your own charge. When you are such will cost you ount of money the lender collects from inside the SRP at the closure – this gives new debtor the advantage so you can discuss.

Do you really re-finance away from an FHA loan so you’re able to a traditional loan?

If you have an FHA financing, one may re-finance so you’re able to a normal financing once you have 5% collateral of your house. For individuals who meet up with the home collateral eligibility conditions, refinancing so you’re able to a normal loan can present you with the main benefit of all the way down rates of interest and allow you to receive rid of your private home loan insurance (when you yourself have at the very least 20% equity of your home).

But just since it is you are able to to refinance from an enthusiastic FHA mortgage in order to a normal financing, it may not create economic feel to suit your state. You’ll need to consider the online concrete benefit for your private finances. And additionally, this can require that you offer asset confirmation and you may probably need to pay to have a separate home assessment.

At the same time, a keen FHA Improve Refinance helps you rapidly miss this new month-to-month percentage on your own current FHA financing and you may without so much documentation or an appraisal.

Who’ll fool around with a keen FHA Streamline Re-finance?

The newest FHA Improve Refinance system really works simply for most recent FHA mortgage proprietors. And you may, it will not work for every FHA homeowner.

To utilize which re-finance option, a homeowner should be able to take advantage of they. Advantages include providing a lesser month-to-month homeloan payment or changing from a changeable-price home loan so you can a fixed-rate mortgage.