An introduction to Home Depot Capital

Our home Depot Company also offers financially rewarding resource choices to their individuals. Consumers to find devices, gadgets, and create-it-yourself products can use investment selection given by Household Depot.

Their a handy method for pages as they do not you would like to join 3rd-category financial support. Nearest and dearest Depot also offers investment and their best individual and you can you might endeavor credit notes with more resource small print.

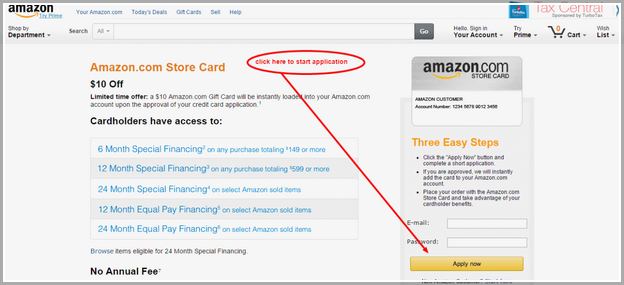

The loan app process is not difficult and you may individuals may use online or when you attend a beneficial shop. The application greeting criteria, pricing, or any other criteria disagree on the some situations (talked about below).

Domestic Depot Mastercard

Citi lender. However, as opposed to most other credit cards, they can you need to be used in shopping at the Home Depot metropolitan areas and you will other sites sites.

They credit card also offers 0% cost if the profiles spend a complete matter within half a year. perhaps not, you’re going to have to spend accrued desire for those who have one kept harmony adopting the venture period.

- 0% notice whether your paid off contained in this half a year out-of your selling period for the commands out of $299 or maybe more. Continue reading Domestic Depot Home loan Refused 5 Causes You must know