Has a partner working full-go out (otherwise keeps a stable income your self)

Receive a scholarship earnings

Although many lenders wouldn’t consider it income, you will find several who can accept income you can get out of an effective scholarship. Depending on the type of grant, loans Battlement Mesa CO they are able to offer you to thousands of dollars when you look at the money per semester from research, which will let enhance your chances of acceptance which have a lender.

- Fellowships;

- College or university scholarships; and you can

- Commonwealth scholarships

Other kinds of scholarships and grants are unlikely getting acknowledged, like HECS exemptions, payment exemptions, additional allowances, head costs off tuition an such like. So you’re able to properly sign up for a home loan lower than a grant, you might should keep the next planned:

- Might you would like a letter out of your school guaranteeing the scholarship so you’re able to post towards the financial;

- You should establish just how long was left on your own grant – which have at least 1 year kept is very effective

Because most regarding loan providers won’t accept lead software to possess scholarship users, you will be better prepared by probably a mortgage broker who can help you find the right one because of the circle. You can increase possibility of acceptance with a new income stream on software.

Lenders assess the home money making an application for financing, that is the reason it is basically smoother for 2 applicants to end up being approved rather than you to. If you are however during the college or university otherwise TAFE, but have a partner or mutual applicant generating a reliable complete-earnings, then a lender can be likely to offer the go-in the future. The same can be applied for those who have an income your self, whether that’s a side-hustle, part-time jobs otherwise a company you possess.

Another idea is to adhere to a similar jobs before you implement because most lenders will require that feel the same workplace for at least six months, and you will stretched if you find yourself for the an informal part, Ms Osti said.

Wade desire-just

Interest-only (IO) lenders tend to have lower initially payments than simply dominating and you can appeal (P&I) home loans, for a period (1-5 years generally) you merely need to pay the interest component of the mortgage, maybe not the main lent, meaning your payments was notably quicker.

Across the life of the mortgage, not, your desire costs might be higher than if you would repaid P&We for your financing several months. You’ll be able to you would like more substantial deposit.

Interest-only home loans

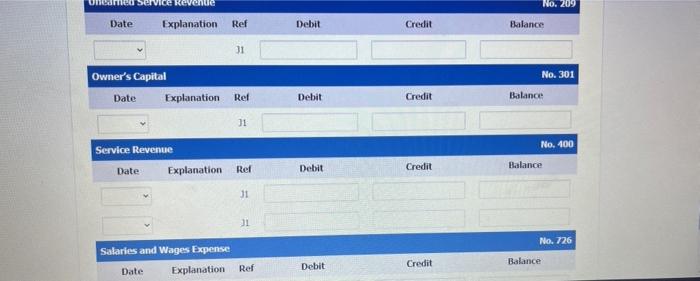

Purchasing property otherwise seeking to refinance? The new desk below keeps mortgage brokers which includes of the reasonable rates in the business having owner-occupiers seeking to pay focus-merely.

Base conditions of: an excellent $eight hundred,000 loan amount, adjustable, repaired, dominant and you will focus (P&I) & notice only (IO) home loans which have a keen LVR (loan-to-value) proportion with a minimum of 80%. Although not, brand new Evaluate Family Loans’ dining table allows calculations to get generated into details while the chosen and you can type in because of the associate. Certain points might be marked just like the marketed, checked otherwise paid and will appear prominently from the tables irrespective of of their characteristics. Every factors will listing the brand new LVR for the device and you will rates which are clearly typed into tool provider’s website. Month-to-month money, while the legs conditions try changed because of the affiliate, depends on chose products’ advertised pricing and you will calculated by the amount borrowed, payment type of, financing term and LVR just like the enter in by member/you. *The fresh Assessment price is dependant on a good $150,000 loan more than twenty five years. Warning: it comparison price holds true simply for this situation and could maybe not were all of the costs and you will charge. Other words, fees or any other loan numbers can result in another type of investigations rate. Cost right as of . Consider disclaimer.