How can you Rating a home loan In the place of a credit score?

One of many ill-effects-or front positives-of becoming and you can way of living debt-100 % free is you sooner or later enjoys a credit rating of no. If that is your, well-done! You happen to be unscorable, and since you might be undetectable so you’re able to credit whales and credit reporting agencies, your face a different difficulties: How will you prove to a mortgage lender you are a professional debtor without a credit history?

It takes a bit more work-but never lose hope. You can purchase a home loan instead a credit history. It’s completely worth every penny. And you may we’ll assist you how.

Whilst getting a mortgage versus a credit score demands way more paperwork, it is really not impossible. You simply need to come across a zero borrowing home loan company who is willing to do something called guidelines underwriting-such as our very own family unit members from the Churchill Financial.

Manual underwriting was a give-toward study into your power to pay off loans. After all, you happen to be about to accept a home loan, plus bank would like to see you can https://speedycashloan.net/loans/payday-loans-with-no-checking-account/ take care of it.

step 1. Provide evidence of money.

The initial hoop was files-thousands of paperwork. You’ll need to reveal verification of one’s income for the last 1224 months, together with a constant fee records for around five normal month-to-month costs. This type of expenses are priced between:

- Lease

- Bills perhaps not included in your lease repayments

- Phone, cell phone or cord bills

- Top repayments

- Childcare otherwise university tuition costs

The greater amount of proof you could promote of your own with the-time commission records, the greater your odds of qualifying for the mortgage.

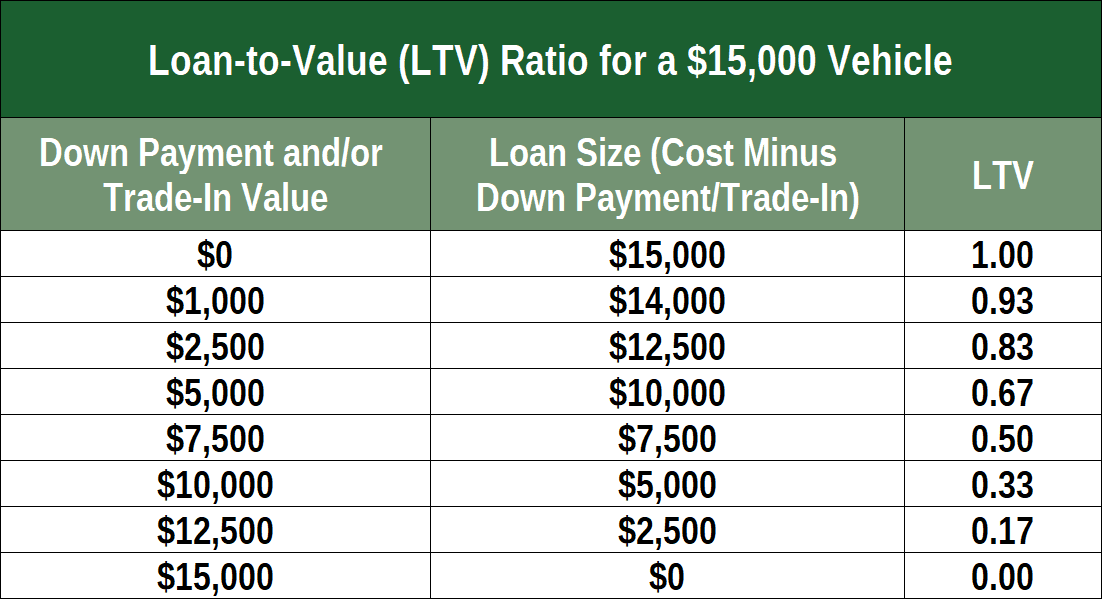

Generally, we advice a downpayment with a minimum of 1020% of the home speed. But if you do not have credit rating, try for 20% or higher since it reduces the lender’s risk and you will demonstrates their capacity to handle currency responsibly.

step three. Choose good 15-season repaired-speed antique home loan.

Zero FHAs. No subprimes. Simply an excellent ol’ 15-12 months repaired-rate conventional financial. And make certain your month-to-month home loan repayments are not any over 25% of one’s monthly grab-household shell out-plus dominating, interest, possessions taxation, home insurance, private home loan insurance rates (PMI) and don’t forget to take on homeowners connection (HOA) costs. That may prevent you from being domestic terrible! This is the only mortgage i ever highly recommend within Ramsey once the it offers the overall lower total cost.

What’s a credit score?

A credit history is actually a good three-hand count you to definitely actions how good you pay off obligations. Basically, a credit history try an enthusiastic “Everyone loves debt” score. They claims you got debt prior to now, and you may you’ve been immense, average or terrible from the using they back.

About three big credit agencies-TransUnion, Experian and you may Equifax-explore borrowing from the bank-scoring patterns, such as VantageScore and you can FICO, to come up with a score that range out-of 300850.

However, trust all of us about this-a credit score is not proof successful economically. Yes, you can see many people that brag about their credit history for example it is some type of come across-upwards line (“on FICO level, I am an enthusiastic 850″). Avoid being fooled. A credit rating doesn’t size your own money, earnings or a job standing-they procedures the debt.

What is the Difference between Zero Credit and you will Lowest Credit?

- No credit score: It means you have avoided loans. I enjoy this at Ramsey since financial obligation is dumb. If you have achieved zero credit rating, congrats! Please remember, you could however buy a house no credit history in the event that your manage a loan provider who would tips guide underwriting.

- Low borrowing (poor credit): It indicates you might have generated big bucks problems previously: You submitted personal bankruptcy, defaulted on the a home, or racked upwards loads of credit debt which you have not been capable repay. A low credit score helps it be much harder on the best way to find a loan provider who is prepared to leave you a home loan.

When you yourself have a minimal credit history, repay all of your current obligations, do not skip people costs, and you will wait until your credit rating disappears before trying buying a property. It is smoother for you to get a mortgage with no credit score than simply a low one to-believe united states.

Most other Mortgage Choices for No Borrowing from the bank or Reduced Borrowing from the bank

When you yourself have zero credit otherwise below stellar borrowing, loan providers will often are talking you for the a keen FHA loan. But do not be seduced by it. An enthusiastic FHA financing is actually a complete split-off-it is a lot more high priced than simply a traditional mortgage.

FHA loans was indeed crafted by the us government and also make to invest in a great domestic more relaxing for very first-day home buyers or people that cannot without difficulty qualify for a good conventional mortgage.

The newest qualifications into an FHA financing are lowest-so low, indeed, that in the event that you don’t have any credit score (otherwise a reduced credit score) as well as minimum a great step three.5% down-payment, you can most likely be considered.

On the surface, FHA funds appear simple. Exactly what could be completely wrong having that loan system built to assist first-day home buyers pick belongings? However, under the reasonable-entry standards are a loan you to definitely lots you up with substantial notice charges and additional mortgage insurance coverage costs that produce you pay large a lot of time-identity costs.

Run a good RamseyTrusted Mortgage company

When you yourself have no credit history and do not wanted any challenge while getting home financing, work on our very own members of the family in the Churchill Home loan that happen to be pros at the undertaking guide underwriting. Churchill Financial is filled with RamseyTrusted financial professionals whom indeed trust in aiding you accomplish personal debt-totally free homeownership.

Ramsey Possibilities might have been dedicated to helping anyone win back power over their funds, make wealth, build their management experience, and you will enhance their lifestyle through private advancement as 1992. Millions of people used our monetary guidance using twenty two guides (together with twelve federal bestsellers) authored by Ramsey Force, and additionally a couple of syndicated broadcast suggests and you can 10 podcasts, having over 17 million a week audience. Get the full story.