How to decide on the loan financing that’s right for you

Rating quick decisioning.

- Thought how long you plan to reside your home

- Evaluate the endurance having you are able to speed grows

- Want to reason for settlement costs

- Remember that more substantial down payment will get mean smaller monthly premiums after

Preferred Reasonable Financial

Basic available choice with just minimal initial costs. Generate a down payment as little as 3% and steer clear of individual mortgage insurance premiums. 3

Real estate loan listing.

To keep big date on your own app, you can start building your documents and you can information beforehand. Access our handy printable list to help you get started.

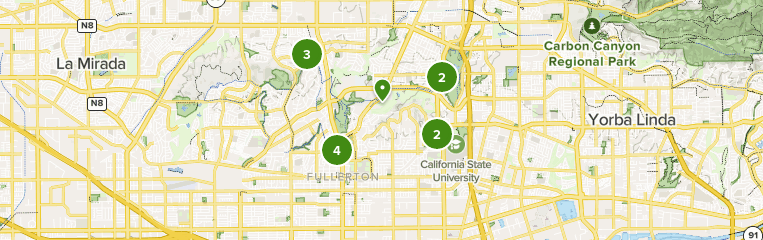

Come across my personal nearby part otherwise Atm

step 1 The financing are at the mercy of borrowing from the bank comment and acceptance. Costs, system small print will vary of the condition as they are susceptible to transform with no warning.

2 The fresh new HomeReady Program is actually a registered signature regarding Fannie mae. Fannie mae is not affiliated with Prominent Bank. Extra system facts arrive into Fannie mae web site. Individuals need certainly to fulfill HomeReady qualification and you can degree standards, and receive loan approval. Borrower earnings need to be below 80% out-of area meridian income (AMI) since the discussed of the Federal national mortgage association. A great step 3% down-payment and you will financial insurance rates are essential. First-date homebuyers will need to done an excellent homebuyer degree movement. New HomeReady System is even available for refinances.

step three Standard Sensible Financial is only available for the purchase out of an initial house assets found inside Prominent Lender analysis urban area. Earnings constraints pertain and you can an effective homebuyer knowledge way is required. All household financial loans try at the mercy of borrowing and you may possessions acceptance. Pricing, system small print try at the mercy of changes with no warning. Not totally all products are available in every claims and for all the wide variety. Almost every other restrictions and you can limitations implement.

4 Individuals need to meet Federal Home loan Financial Homebuyer Fantasy and you may/otherwise Homebuyer Fantasy Plus eligibility and you can degree requirements. Subject property have to be into the a popular Lender discussed assessment town. The family need certainly to meet up with the income recommendations established about Homebuyer Fantasy direction which have a complete house income out-of 80% or below of the city average income to your county in which the home are bought can be found, modified to have family size.

5 The HomeFirst Downpayment Direction Program info come on Nyc Agency of Construction Conservation and Advancement website. Consumers must see HomeFirst eligibility and you will qualification requirements. Borrowers have to be a first-big date homebuyer and you may over a good homebuyer training path. Borrower income need to be below 80% of urban area average income (AMI) since the dependent on this new You.S. Institution regarding Construction and you will Metropolitan Invention (HUD). A step 3% down-payment is needed. Society Housing Characteristics of the latest York Area, Inc. (NHSNYC) administers the fresh York City Institution out of Construction Maintenance and you can Development’s HomeFirst Downpayment Advice Program.

six The loan Origination Percentage Waiver was good waiver of your own Bank’s or even simple origination fee which can be limited to your service services profile products to department restrictions for residential mortgages (commands and you can refinances) in which the house is a holder-occupied priily, an effective condo, otherwise a good cooperative possessions kind of), based in Prominent Bank’s evaluation city, and you will receive inside a majority minority census region (MMCT) Most other constraints and you can constraints will get pertain.

For brand new York Consumers: Common Financial try regulated because of the Ny Department out of Financial Attributes (NYDFS). So you can document a criticism get in touch with Nyc State dept. out of Monetary Properties Consumer Recommendations Tool at the step 1-800-342-3736 otherwise by going to the brand new Department’s website at dfs.new york.gov. Well-known Financial can get make use of third party service providers to help you service the financing but stays responsible for all the measures taken because of the 3rd class.

For more information off charges to possess mortgages and domestic equities maintained by the Well-known Bank, please discover the Residential Mortgage and you will House Collateral Product Servicing Charge here. Does not apply to mortgage loans serviced because of the Popular Mortgage Services. To have facts about Portland bank for personal loan lowest interest rate charge to have Preferred Financial Services levels, please sign in for your requirements.

Ny Owners: Well-known Lender brings code accessibility qualities into the Foreign-language. Please note you to definitely Preferred Lender enjoys customer care options to speak with a real estate agent in Foreign-language. Popular Bank’s language access services is actually limited to verbal telecommunications with a real estate agent in Foreign-language. Well-known Lender will not bring another vocabulary supply services in Language (and other words) and, particularly, does not render translations of any data files in the Spanish (or any other words).

An interpretation and you will breakdown out-of aren’t-used debt collection terms and conditions is available in several dialects towards the Nyc Agency out-of Consumer Affair’s webpages,

Delight never ever show your own Preferred security passwords with people. Prominent can never ask you for their code using email address, social media or a 3rd-group webpages. Discover more.